Part II

In Part I of “Tactical vs Strategic Licensing” (October’s blogpost), we focused on the differences between tactical and strategic technology licensing, including the potential business usefulness of strategic licensing. Here we explore in greater detail the “right” business processes, resources, and organization for a successful transformation from tactical to strategic technology licensing.

From an operations perspective, the transformation from tactical to strategic licensing requires a supporting evolution in three distinct areas:

Business processes

Resources

Organization

To begin to understand where you are as a company along the “tactical” to “strategic” licensing continuum, consider fully the answers to the following questions:

Do we have the right processes in place?

For example, if you plan to license technologies which you are using yourself to support the products you sell, you’ll need to adopt a “business case” approach to assess the impact of licensing to third parties on your business that’s supported by self-manufacturing. A “best practice” followed by the most successful integrated manufacturing/licensing companies is the development of a formal, comprehensive business case approach, similar in depth and breadth to the company’s existing five-year business plans for its product lines.

Do we have licensable technologies?

Assuming that you decide to engage in technology licensing as a business per se, how are you going to generate licensable technologies on an ongoing basis? What is the interaction between the licensing group and the technology development groups? In most cases, operating units or business units continue to fund R&D, with the licensing group getting at least a voice in the early stages of the technology development process.

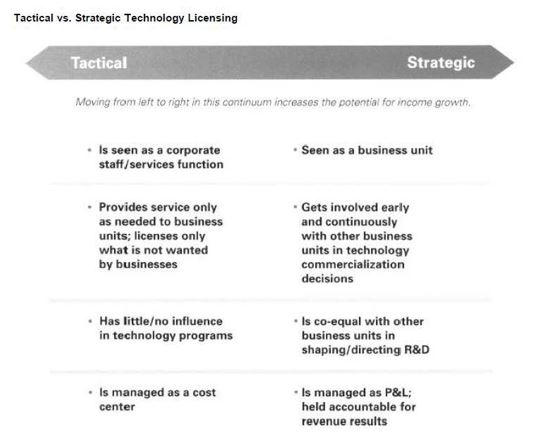

Does our licensing organization look like a P&L?

The transition from tactical to strategic often involves shifts in organization. Companies that have begun to treat licensing as an identifiable and separate business activity often put someone with successful P&L experience in charge. The group is then “built-out” with a full-time supporting cast dedicated to commercializing the licensable technologies. The performance of strategic licensing organizations is measured in terms of income generated.

A graphic depicting the “tactical” to “strategic” continuum is shown below. It provides a snapshot of the extent to which a licensing organization “looks” like a P&L.

Is licensing a viable business strategy element for you?

Technology licensing can be a useful vehicle for technology-rich companies. In Part III of “Tactical vs Strategic Licensing” (our next month’s blogpost), we’ll provide you with a checklist of key issues to address and which will lead you to the answer to this question!

For more on creating value by commercializing technology, see https://www.prakteka.com/category/technology-commercialization/

We at Prakteka LLC developed our expertise in market penetration strategies in the context of numerous and diverse client assignments, all focused on using technology to create business value. We are here to help you answer business-critical technology questions, too. For a customized plan for your needs, contact us at http://www.prakteka.com/contact-us/